02 Jan 2020 Personal Tax Guide – 2019 Year-End Tax Planning Tips

In this first chapter of the 2020 Tax Guide, EisnerAmper provides year-end tax strategies for 2019.

In addition to saving income taxes for the current and future years, effective tax planning can reduce eventual estate taxes, maximize the amount of funds you will have available for retirement, reduce the cost of financing your children’s education, and assist you in managing your cash flow to help you meet your financial objectives.

Tax planning strategies can defer some of your current year’s tax liability to a future year, thereby freeing up cash for investment, business, or personal use. This can be accomplished by timing when certain expenses are paid, or controlling when income is recognized. Tax planning allows you to take advantage of tax rate differentials between years. However, if tax rates rise in a subsequent year, extra caution may be necessary. As a result of the Tax Cuts and Jobs Act of 2017 (“TCJA”), the alternative minimum tax (“AMT”) will likely affect less taxpayers than in past years, so some of the tax strategies utilized in prior years will no longer be applicable. The key factors you should consider when identifying strategies to minimize your taxes are:

- Prior to 2018, while residents of states with high income and property taxes (such as New York, California, Connecticut, Pennsylvania and New Jersey) were able to deduct the full amount of state income and property taxes against federal taxable income, they most likely did not receive a benefit if they were subject to the AMT. Beginning after December 31, 2017, state income and property tax deductions are limited to $10,000 and the deduction continues to be subject to the AMT. It is now less likely that the AMT will apply to many taxpayers.

- In addition to the limitations on state income and property taxes, miscellaneous itemized deductions such as investment expenses, unreimbursed business expenses, and professional fees are no longer deductible. Residents of New York will still be able to deduct real estate taxes and miscellaneous itemized deductions on their NYS income tax returns, though they may be limited based on their adjusted gross income (“AGI”). Also, exemptions are completely repealed and instead have been consolidated into the standard deduction.

- The current top long-term capital gains tax rate is 20%. Including the additional 3.8% Medicare Contribution Tax on net investment income, the top federal long-term capital gains rate could be 23.8% and the top federal short-term capital gains tax rate could be as much as 40.8% in 2019 and 2020.

- Under the TCJA, taxpayers may defer tax on prior short-term and/or long-term capital gains if the amount of the gain is invested in a qualified opportunity fund. Investors can reinvest their capital gains into areas that need investment (qualified opportunity zones). Gains can come from any investment, whether that is from stocks, bonds, real estate or partnership interests. To qualify for certain tax breaks, investors must invest their capital gains in a qualified opportunity fund within 180 days of realizing those gains. The money cannot be invested directly into a property, and funds must invest 90% of their capital into opportunity zone properties. For gains realized from flow-through entities, the date realized is deemed to be December 31 (or the year-end of the entity if a fiscal year).

- Under current law, the complex netting rules have the potential effect of making your long-term capital gains subject to short-term rates, so you must carefully time your security trades to ensure that you receive the full benefit of the lowest capital gains tax rate.

- Gift and estate taxes can reduce the amount your beneficiaries will receive by 40% to 50%, depending on which state one is a resident of at date of death. However, there are planning techniques and strategies available to maximize the amount of wealth that is preserved for your family.

TAX PLANNING GOALS

Proper tax planning can achieve the following goals:

- Reduce the current year’s tax liability.

- Defer the current year’s tax liability to future years, thereby increasing availability of cash for investment, business, or personal needs.

- Reduce any potential future years’ tax liabilities.

- Maximize the tax savings from allowable deductions.

- Minimize the effect of the AMT on this year’s tax liability.

- Maximize tax savings by taking advantage of available tax credits.

- Maximize the amount of wealth that stays in your family.

- Minimize capital gains tax.

- Minimize the Medicare Contribution Tax on net investment income.

- Avoid penalties for underpayment of estimated taxes.

- Manage your cash flow by projecting when tax payments will be required.

- Minimize potential future estate taxes to maximize the amount left to your beneficiaries and/or charities (rather than the government).

- Maximize the amount of money you will have available to fund your children’s education as well as your retirement.

YEAR-END TAX PLANNING TIPS

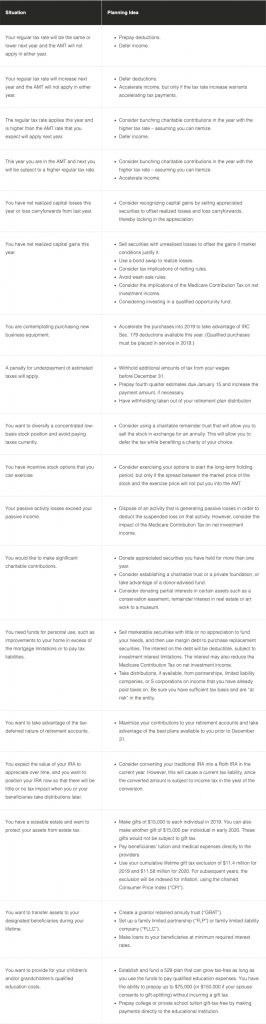

Tax Tip 1 provides a snapshot of key strategies geared toward helping you achieve your planning goals. It includes ideas to help you reduce your current year’s tax as well as any potential future taxes. While this chart is not all inclusive, it is a good starting point to help you identify planning ideas that might apply to your situation. Keep in mind that many of the strategies involve knowing what your approximate income, expenses and tax rates will be for the current and subsequent years and then applying the applicable tax law for each year to determine the best path to follow. Implementation of many of these ideas requires a thorough knowledge of tax laws, thoughtful planning and timely action.

Timing when you pay deductible expenses and when you receive income (to the extent you have control) can reduce your taxes. Timing expenses and income can also defer some of your tax liability to next year (or even later years) giving you, rather than the government, use of your money.

To gain the maximum benefit, you need to project, as best you can, your tax situation for the current and subsequent years. This will help you identify your tax bracket for each year. Your year-to-date realized long- and short-term capital gains and losses should be included in your projections. Be sure to consider prior-year loss carry forwards (if any). Based on these results, you can decide what steps to take prior to year-end. You will be able to decide whether or not you should prepay deductions and defer income, defer expenses and accelerate income, realize capital losses, or lock in capital gains.

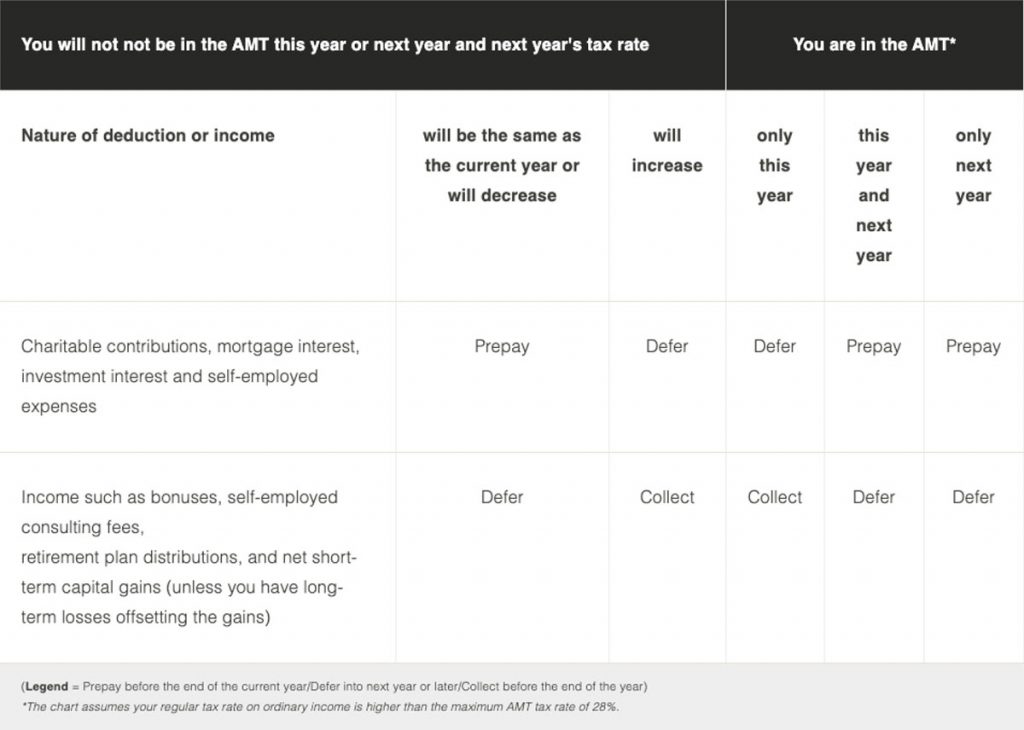

Tax Tip 2 offers basic guidance for deciding when to prepay or defer deductible expenses and when to defer or collect taxable income.

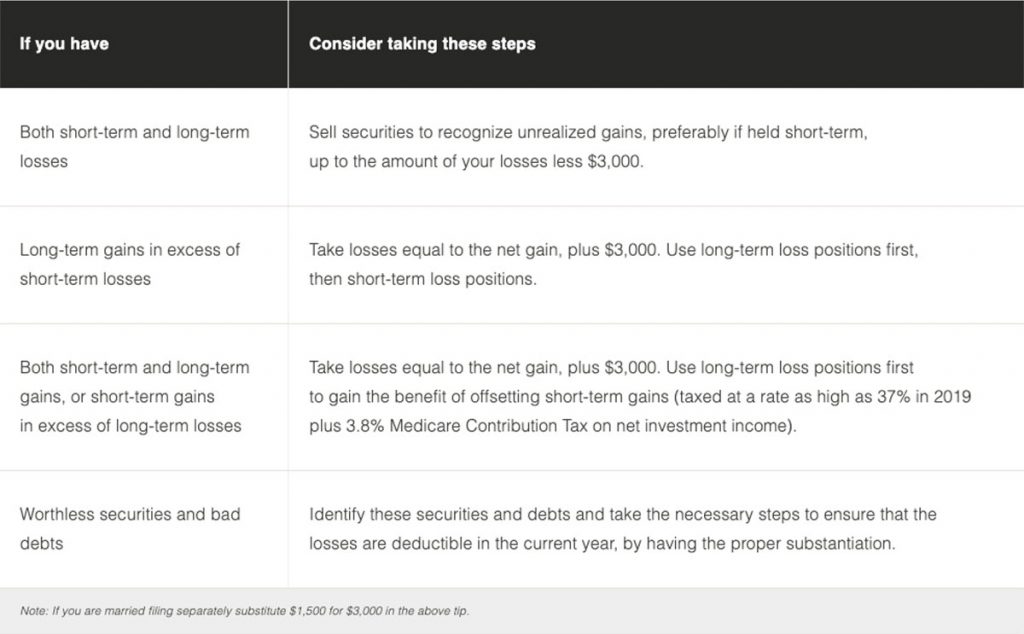

Tax Tip 3 offers steps to follow relating to realized capital gains and/or losses, and the type of gains and losses you should trigger.

EXPENSES YOU CAN PREPAY

Here are the most common deductible expenses you can easily prepay by December 31, if appropriate:

Charitable Contributions

You can deduct charitable gifts of cash up to 60% of your AGI, tangible personal property, such as clothing and household goods, up to 50% of your AGI and charitable gifts of appreciated capital gain properties up to 30% of your AGI. These percentages apply to gifts made to public charities. Be sure to work through the calculations though, as gifting different types of property to charities with varying exempt status (such as private foundations), can limit the amount of the deduction allowed in a particular year.

State and Local Income Taxes and Property Taxes

A taxpayer may claim an itemized deduction of up to $10,000 ($5,000 for married filing separately) for the aggregate of (1) state and local income taxes and (2) state and local property taxes paid.

Miscellaneous Itemized Deductions

All miscellaneous itemized deductions that are subject to the limitation of 2% of AGI will be suspended until years beginning after December 31, 2025.

Mortgage Interest

Before the end of 2019, consider prepaying your mortgage payment for next January in the current year in order to accelerate the deduction.

Margin Interest

Before the end of 2019, be sure to pay any margin interest before December 31, since interest accrued at year-end is only deductible if actually paid. This may also reduce the Medicare Contribution Tax on net investment income.

Business Equipment

Before the end of 2019, accelerate the purchases of business equipment to take advantage of expensing allowances, subject to certain limitations. To qualify, the property must be placed in service in the year of the intended deduction.

Tax Tip 1 – Key Tax Planning Strategies

INCOME YOU CAN ACCELERATE OR DEFER

Timing income can be more difficult than timing deductions, but here are some types of income that you may be able to control the timing of receipt so you can gain the advantage of having the income taxed in a year that you are in a lower tax bracket.

Cash Salaries or Bonuses

If you anticipate your current year’s income tax rate to be lower than next year’s rate, you can accelerate salary or bonuses into the current year. You would need to determine if there are strict limitations on amounts that can be accelerated. However, if next year’s rate is lower than your current year’s rate, it may make sense to defer such income until next year provided the income is not constructively received (made available to you in the current year).

Consulting or Other Self-Employment Income

If you are a cash-basis business and you anticipate your current year’s tax rate to be lower than next year’s rate, you can accelerate income into the current year. Otherwise, you would want to defer such income.

Retirement Plan Distributions

If you are over age 59½ and your tax rate is low this year, you may consider taking a taxable distribution from your retirement plan even if it is not required, or consider a Roth IRA conversion. Individuals of at least age 70½ are allowed to make tax-free distributions of up to $100,000 from individual retirement accounts (“IRAs”) to public charities. This allows an individual to exclude the distribution from income; thereby reducing your state income taxes in states that limit or disallow the charitable contribution deduction.

Capital Gains

The following ideas can lower your taxes this year:

- If you have unrealized net short-term capital gains, consider selling the positions and realize the gains in the current year if you expect next year’s tax rate to be higher. Only consider this strategy if you do not otherwise intend to hold the position for more than 12 months, making it eligible for the long-term capital gain rate of 20%, exclusive of the additional Medicare Contribution Tax. However, you may be able to apply the netting rule which may result in the offsetting of long-term losses to short-term gains, resulting in a tax savings of 37% in 2019 rather than 20%.

- Considering investing in a qualified opportunity fund.

- Review your portfolio to determine if you have any securities that you may be able to claim as worthless, thereby giving you a capital loss before the end of the year. A similar rule applies to bad debts.

- Avoid wash sales. Loss recognition is disallowed if the same or substantially identical security is purchased 30 days before or after the sale of the security that created the loss.

- Consider a bond swap to realize losses in your bond portfolio. This swap allows you to purchase similar bonds and avoid the wash sale rule while maintaining your overall bond positions.

- Similarly, you may consider selling securities this year to realize long-term capital gains that may be taxed at the more favourable rate this year, and then buying them back to effectively gain a step-up in basis. Since the sales are at a gain, the wash sale rules do not apply.

Tax Tip 2 – AMT Tax Planning Strategies

Real Estate and Other Non-Publicly Traded Property Sales

If you are selling real estate or other non-publicly traded property at a gain, you would normally structure the terms of the arrangement so that most of the payments would be due next year. You can use the installment sale method to report the income. This would allow you to recognize only a portion of the taxable gain in the current year to the extent of the payments you received, thereby allowing you to defer much of that tax to future years.

U.S. Treasury Bill Income

If you have U.S. Treasury Bills maturing early next year, you may want to sell these bills to recognize income in the current year if you expect to be in a lower tax bracket this year than next year.

BUNCHING DEDUCTIONS

Medical Expenses

These expenses are deductible only if they exceeded 10% of your AGI, an increase from 7.5% in prior years. Therefore, bunching unreimbursed medical expenses into a single year could result in a tax benefit. Medical expenses include health insurance and dental care. If you are paying a private nurse or a nursing home for a parent or other relative, you can take these expenses on your tax return even if you do not claim the parent or relative as your dependent, assuming you meet certain eligibility requirements.

Charitable Contributions

As a result of the TCJA, many itemized deductions have been eliminated or limited. The deduction for the charitable contribution is the exception, as it has virtually been untouched by the new law. At the same time, the standard deduction has increased substantially. An individual can deduct the larger of either his/ her standard deduction or itemized deductions. Thus, in order to maximize the deduction for charitable contributions, it might be best to bunch gifts to charities in one year, so the individual’s charitable contributions exceed the standard deduction amounts, and he or she will be able to itemize. Similarly, funding a donor-advised fund, private foundation or a charitable trust in a particular year may be effective in maximizing the tax benefit of such charitable deductions.

Tax Tip 3 – Year-End Capital Gains and Losses

ADJUST YEAR-END WITHHOLDING OR MAKE ESTIMATED TAX PAYMENTS

If you expect to be subject to an underpayment penalty for failure to pay your current-year tax liability on a timely basis, consider increasing your withholding and/or make an estimated tax payment between now and the end of the year in order to eliminate or minimize the amount of the penalty.

UTILIZE BUSINESS LOSSES OR TAKE TAX-FREE DISTRIBUTIONS

It may be possible to deduct losses that would otherwise be limited by your tax basis or the “at risk” rules. Or, you may be able to take tax-free distributions from a partnership, limited liability company (“LLC”) or S corporation if you have tax basis in the entity and have already been taxed on the income. If there is a basis limitation, consider contributing capital to the entity or making a loan under certain conditions. See further discussion in the chapter on business owner issues and depreciation deductions.

PASSIVE LOSSES

If you have passive losses from a business in which you do not materially participate that are in excess of your income from these types of activities, consider disposing of the activity. The tax savings can be significant since all losses become deductible when you dispose of the activity. Even if there is a gain on the disposition, you can receive the benefit of having the long-term capital gain taxed at 23.8% (28.8% if the gain is subject to depreciation recapture) inclusive of the Medicare Contribution Tax with all the previously suspended losses offsetting ordinary income at a potential tax benefit of 40.8% in 2019 inclusive of the Medicare Contribution Tax.

INCENTIVE STOCK OPTIONS

Review your incentive stock option plans (“ISOs”) prior to year-end. A poorly timed exercise of ISOs can be very costly since the spread between the fair market value of the stock and your exercise price is a tax preference item for AMT purposes. If you are in the AMT, you will have to pay a tax on that spread, generally at 28%. If you expect to be in the AMT this year but do not project to be next year, you should defer the exercise. Conversely, if you are not in the AMT this year, you should consider accelerating the exercise of the options; however, keep in mind to not exercise so much as to be subject to the AMT.

ESTATE PLANNING

If you have not already done so, consider making your annual exclusion gifts to your beneficiaries before the end of the year. You are allowed to make tax-free gifts of up to $15,000 per year, per individual ($30,000 if you are married and use a gift-splitting election, or $15,000 from each spouse if the gift is funded from his and her own separate accounts). By making these gifts, you can transfer substantial amounts out of your estate without using any of your lifetime exclusion. Also, try to make these gifts early in the year to transfer that year’s appreciation out of your estate. For 2020, the annual exclusion for gifts is $15,000 per donee.

Furthermore, because of the increased cumulative lifetime gift exclusion in 2019, you may wish to make additional gifts to fully utilize such exclusion of $11.4 million ($22.8 million for married couples). For 2020, the cumulative lifetime gift exclusion increases to $11.58 million ($23.16 million for married couples). The lifetime gift exclusion has doubled as a result of the TCJA; however, it will sunset at the end of 2025 reverting back to the maximum lifetime gift exclusion in effect before the TCJA became law. When combined with other estate and gift planning techniques such as a grantor retained annuity trust, tax planning strategies may enable you to avoid estate and gift taxes and transfer a great deal of wealth to other family members (who may be in a lower income tax bracket or may need financial assistance).

Note: The amount of the lifetime gift exclusion will be adjusted annually for the chained consumer price index (“CPI”).

TAX STRATEGIES FOR BUSINESS OWNERS

Timing of Income and Deductions

If you are a cash-basis business and expect your current year’s tax rate to be higher than next year’s rate, you can delay billing until January of next year for services already performed in order to take advantage of the lower tax rate next year. Similarly, even if you expect next year’s rate to be the same as this year’s rate, you should still delay billing until after year-end to defer the tax to next year. You also have the option to prepay or defer paying business expenses in order to realize the deduction in the year that you expect to be subject to the higher tax rate. This can be particularly significant if you are considering purchasing (and placing in service) business equipment. If you are concerned about your cash flow and want to accelerate your deductions, you can charge the purchases on the company’s credit card. This will allow you to take the deduction in the current year when the charge is made, even though you may not actually pay the outstanding credit card bill until after December 31.

Business Equipment

Tax benefits are available for immediate deduction of business equipment purchased and placed in service in 2019. The amount allowable for full deduction in 2019 under IRC Sec. 179 is $1,000,000 if property placed in service does not exceed $2,500,000. Bonus depreciation was increased to 100% for property placed in service after September 27, 2017. The allowable bonus percentage decreases by 20% each year, beginning in 2023 with 2026 being the last year at 20% bonus. The TCJA expands the definition of qualified property to include used property (as long as the taxpayer did not use the property prior to the purchase).

Note: Under the TCJA, some businesses may not be eligible for the bonus depreciation. For example, bonus depreciation is not allowed for businesses with annual gross receipts of more than $25 million for the prior three years and real estate businesses that elect to deduct 100% of their business interest expenses.

Note: The bonus depreciation is an addback on most state returns while IRC Sec. 179 expense is only a partial addback.

Business Interest

If you have debt that can be traced to your business expenditures – including debt used to finance the capital requirements of a partnership, S corporation or LLC involved in a trade or business in which you materially participate – you can deduct the interest “above-the-line” as business interest rather than as an itemized deduction. The interest is a direct reduction of the income from the business. This allows you to deduct all of your business interest, even if you are a resident of a state that limits or disallows all of your itemized deductions.

Business interest also includes finance charges on items that you purchase for your business (as an owner) using the company’s credit card. These purchases are treated as additional loans to the business, subject to tracing rules that allow you to deduct the portion of the finance charges that relate to the business items purchased. Credit card purchases made before year-end and paid for in 2020 are allowable deductions in 2019 for cash basis businesses.

Note: Interest expense deduction is limited to 30% of adjusted taxable income (“ATI”). Such limitation does not apply to:

- Businesses with average gross receipt that do not exceed $25 million

- Electing real property trade or business

Qualified Business Income Deduction

Qualified business income (“QBI”) is generally defined as net income and deductions that are effectively connected to a U.S. business. Through 2025, the TCJA provides an IRC Sec. 199A deduction for sole proprietors and owners of pass-through entities of a “qualified” business generally equal to 20% of qualified business income, subject to various loss and deduction limitation. Though this deduction is not allowed in calculating the owner’s AGI, it does reduce the taxable income.

Excess Business Losses and Net Operating Losses

Excess losses from all of your trades or businesses are limited to $510,000 (married filing jointly) and $255,000 (all others). Any losses above these amounts will be carried forward as a net operating loss (“NOL”). Beginning in tax years after December 31, 2017, NOLs can no longer be carried back. NOLs can be used to offset 80% of taxable income in future years with any excess to be carried forward indefinitely.

CONCLUSION

Now, more than ever, effective, strategic planning is crucial if one is to achieve certain financial goals and realize tax savings.

—

Written by Marie Arrigo, Tax Partner and Co-Leader of the Family Office Services Practice for the Personal Wealth Advisors Group.

To learn more, contact Eric Altstadter, Partner, EisnerAmper by emailing [email protected] or calling 212.891.4058 or 516.864.8888.

This article is a republication of content originally published by EisnerAmper, https://www.eisneramper.com/2019-year-end-tax-planning-tips-1219/?C=EM, used with permission.

This article is for general information and education only. It is provided as a courtesy to the clients and friends of EisnerAmper. EisnerAmper does not warrant that it is accurate or complete. Opinions expressed and estimates or projections given are those of the authors or persons quoted as of the date of the article with no obligation to update or notify of inaccuracy or change. This article may not be reproduced, distributed or further published by any person without the written consent of EisnerAmper. Please cite source when quoting.

Sorry, the comment form is closed at this time.